6 Way to Building a Stable Portfolio: Strategies for Diversification, Risk Management, and Long-Term Growth

Building a stable portfolio involves diversification, risk management, and aligning your investments with your financial goals and risk tolerance. Here are some steps you can take to build a stable portfolio:

First : Define your investment goals and risk tolerance:

Determine your investment objectives, whether it’s wealth preservation, growth, income generation, or a combination of these. Assess your risk tolerance to understand how much volatility you can comfortably handle

Diversify your investments:

Spread your investments across different asset classes, such as stocks, bonds, real estate, and cash equivalents. Within each asset class, diversify further by investing in different sectors and geographic regions. Diversification helps reduce the impact of any single investment’s performance on your overall portfolio.

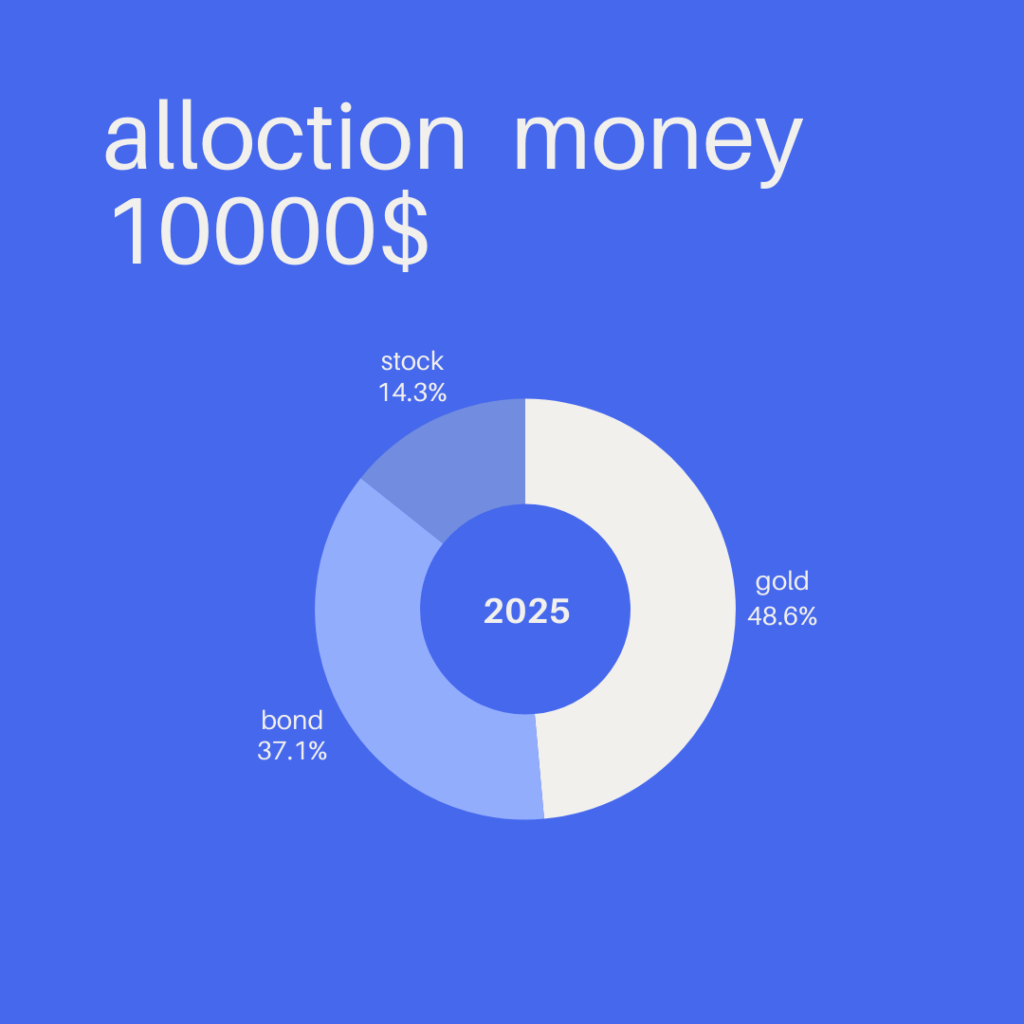

Allocate assets strategically:

Allocate your assets according to your investment goals, time horizon, and risk tolerance. Younger investors with a longer time horizon may have a higher allocation to stocks for growth potential, while older investors or those with lower risk tolerance may allocate more to bonds or other income-generating assets for stability.

Regularly rebalance your portfolio:

Rebalancing involves periodically adjusting your portfolio’s asset allocation to maintain your desired risk-return profile. For example, if one asset class has outperformed and now represents a larger portion of your portfolio than intended, you may need to sell some of it and buy other assets to bring your portfolio back into balance.

Consider dollar-cost averaging:

Instead of investing a lump sum all at once, consider dollar-cost averaging by investing a fixed amount regularly over time. This strategy can help reduce the impact of market volatility on your investments.

Monitor and review your portfolio:

Regularly review your portfolio’s performance and make adjustments as needed based on changes in your financial situation, market conditions, or investment objectives. Stay informed about economic trends, geopolitical events, and other factors that could affect your investments.

Consider professional advice:

If you’re uncertain about how to build and manage a stable portfolio, consider seeking advice from a financial advisor or investment professional who can help you create a customized investment plan based on your goals and risk tolerance.

By following these steps and staying disciplined in your investment approach, you can build a stable portfolio that can help you achieve your financial objectives over the long term.